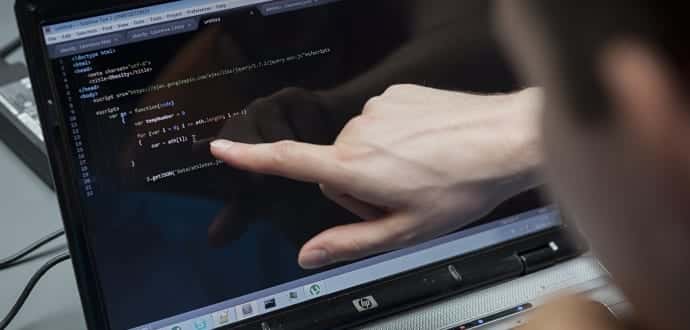

Computer coding error in software from May 1999 to April 2014 costs Citigroup $7 million

A perfect code is appreciated by all but a bad code is bound to generate bad blood and cause losses. This is what happened to the multinational banking group, Citigroup when a computer coding error caused a loss of $7 million.

Citigroup Inc. has agreed to pay $7 million and admitted to wrongdoing to settle Securities and Exchange Commission charges, the financial services firm gave the agency incomplete “blue sheet” information.

The incomplete “blue sheet” was a result of a programming error in the software that Citigroup used from 1999 to 2014 for a whopping fifteen years.

Blue sheets include the time, type, volume, and prices of trades, among other information. In using the software with the error, the SEC said, Citigroup omitted 26,810 transactions in more than 2,300 blue sheet requests.

The mistake was discovered by Citigroup in April 2014 and asked its technical support team to help identify which internal ID numbers they should run a request on.

“We are pleased to have resolved this matter,” a Citigroup spokeswoman said when asked about the situation.

The error was caused when Citigroup introduced new alphanumeric branch codes for its branches in mid 1990. The code made the software that Citigroup used, to filter out any transactions that were given three-digit branch codes from 089 to 100 and used those prefixes for testing purposes. However, the buggy code did not detect transactions when Citigroup introduced new branch codes like 10B, 10C. When Citigroup filed its “blue sheet” with SEC, it carried the data with missing transactions

The error was noticed in 2014 and Citigroup had to pay a penalty of $7 million for misreporting the data due to the buggy code.