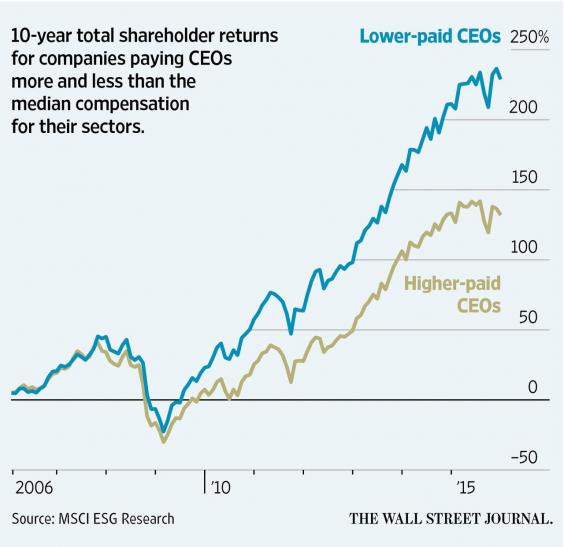

Businesses run by lower-paid CEOs earn greater shareholder return, research finds

Businesses run by the highest-paid CEOs tend to run some of the worst-performing companies, according to a recent study published by MSCI, a New York-based corporate research firm.

“Is the investment in higher executive incentives paying off in terms of long-term shareholder returns?” a senior corporate governance researcher at MSCI asked. “The finding so far is clearly not.”

The study found that for every $100 (£76) invested in companies with the highest-paid CEOs would have increased to $265 (£202) over a decade. However, the same amount invested in the companies with the lowest-paid CEOs would have increased to $367 (£279) over 10 years.

In fact, comparatively low-compensated CEOs “outperformed those companies where pay exceeded the sector median by as much as 39%,” according to the July report, entitled “Are CEOs Paid for Performance?” The report looked at the salaries of 800 CEOs at 429 large and medium-sized US companies between 2005 and 2014 and also looked at the total shareholder return of the companies during the same period.

According to the report: “Equity incentive awards now comprise 70% or more of total summary CEO pay in the United States, based on our calculations. Yet we found little evidence to show a link between the large proportion of pay that such awards represent and long-term company stock performance.

“In fact, even after adjusting for company size and sector, companies with lower total summary CEO pay levels more consistently displayed higher long-term investment returns.”

The study found that one possible factor behind the results was that annual pay reviews and regulatory requirements for pay disclosure meant boards were discouraged from concentrating on long term results. “Closer scrutiny of the relationship between CEO pay and performance over longer time periods could lead to different conclusions,” the report adds.

The MSCI study compared 10-year total shareholder return—stock appreciation plus dividends—and cumulative total CEO pay as reported in proxy-filing summary-compensation tables.

The study also surveyed pay and performance among companies within the same broad economic sectors and found similar results: The top-paid half of CEOs in a sector tended to run companies that performed worse than their peers, while the lower-paid half tended to outperform.

“Whether you look at the entire group or adjust by market-cap and sector, you really get very similar results,” Marshall said.

“The highest paid had the worst performance by a significant margin. It just argues for the equity portion of CEO pay to be more conservative,” Marshall said in a statement.